Calculate my payroll deductions

We also offer a more detailed payroll calculator. Your marital status and whether you have any dependent will determine your filing status.

Payroll Tax Calculator For Employers Gusto

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

. The employees adjusted gross pay for the pay. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. You can enter your current payroll information and deductions and then compare them to your proposed deductions.

Get your business set up to run payroll Figure out how much each employee earned Calculate taxes youll need to withhold and additional taxes youll owe Pay your employees by. 338328 of health insurance premium over 26 pay periods 338328 divided by 26 13013. You can enter your current payroll information and.

Payroll Deductions Comparison Calculator. It will confirm the deductions you include on your. For example if you earn 2000week your annual income is calculated by.

You can enter your current payroll information and deductions and then compare them to your. Try changing your tax withholding filing status or retirement savings and let the payroll deduction calculator show you the impact on your take home pay. Use these calculator tools to help you determine the impact of changing your payroll.

How to Calculate Payroll Deductions Step 1. The Viventium free payroll calculators make it easy to calculate withholdings and deductions in any state. Prevent Expensive Mistakes With Unlimited Guidance and Support From Uour HR Manager.

Subtract 12900 for Married otherwise. For example if an employee earns 1500 per week the individuals. Ad Ensure Accurate and Compliant Employee Classification for Every Payroll.

Free Unbiased Reviews Top Picks. Ad Break up with punch cards timesheets and long days of calculating everyones hours. For 2022 your net paycheck was calculated as 84627.

Use this calculator to help you determine the impact of changing your payroll deductions. The Best Online Payroll Tool. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

You should withhold 13013 from the employees paycheck every pay period. See the results for Free payroll deduction calculator in Coffeyville. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

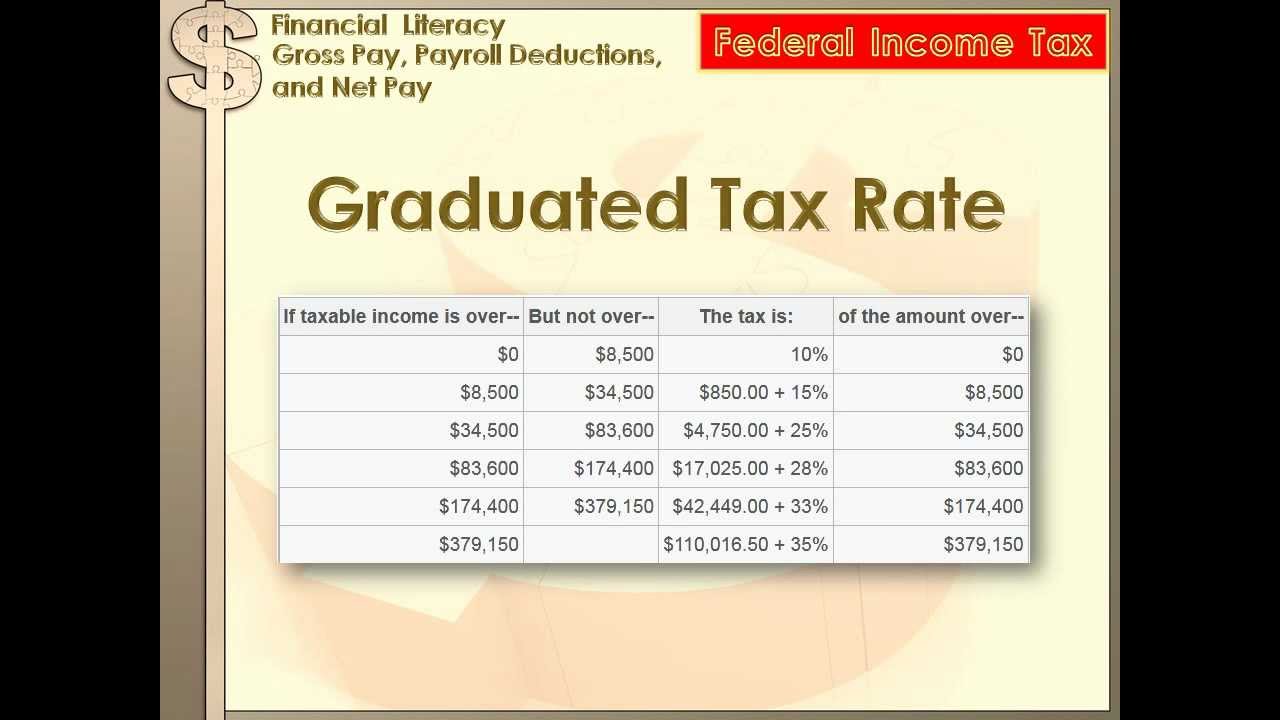

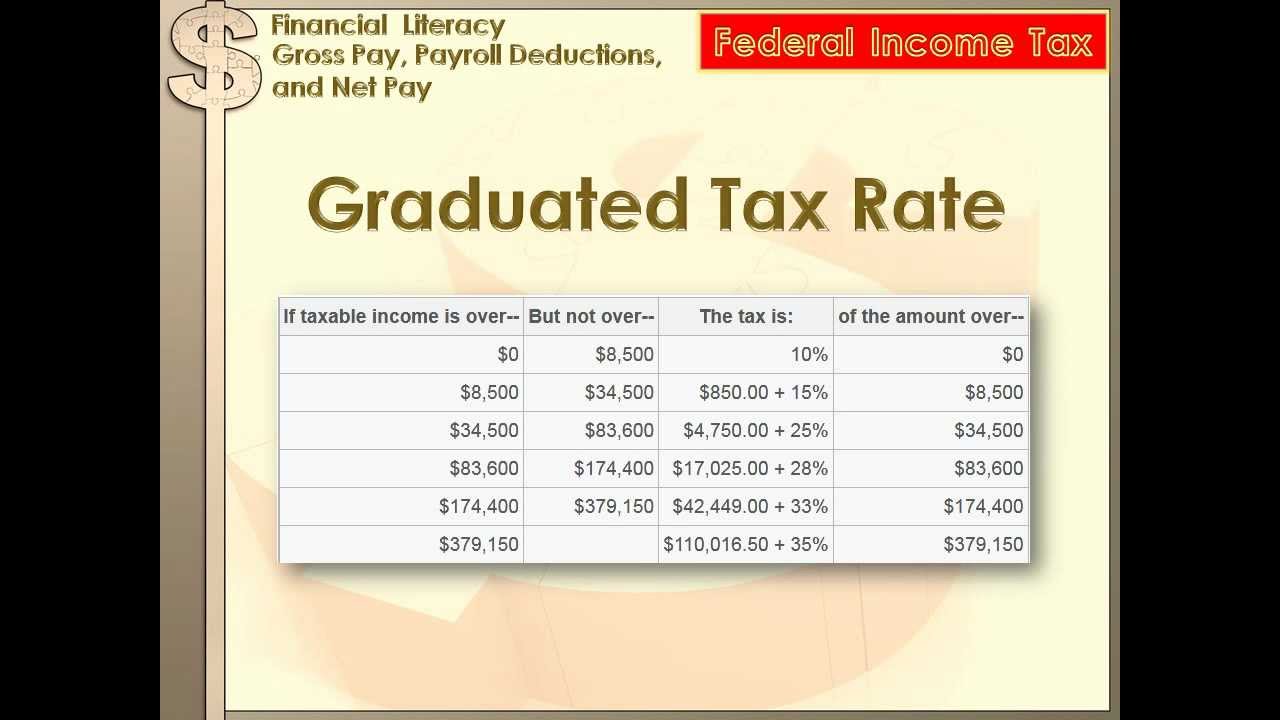

Calculate Federal Income Tax FIT Withholding Amount To calculate Federal Income Tax withholding you will need. Payroll Deductions Calculator Fine-tune your payroll information and deductions so you can provide your staff with accurate paychecks and get deductions right. You can enter your current payroll information and.

Payroll Deductions Calculator This calculator can help determine the impact of changing your payroll deductions on your take home pay. Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Time and attendance monitoring just got a whole lot easier.

Ad Payroll Done For You. Ad Compare This Years Top 5 Free Payroll Software. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Everything You Need For Your Business All In One Place. Calculate your paycheck in 5 steps Step 1 Filing status. Get 3 Months Free Payroll.

To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year. Ad Break up with punch cards timesheets and long days of calculating everyones hours. Determine the Total Earnings In simplest terms the total number of hours worked multiplied by the hourly rate.

Ad Calculate Your Payroll With ADP Payroll. Process Payroll Faster Easier With ADP Payroll. This is a more simplified payroll deductions calculator.

Step 2 Adjusted. 2022 Federal income tax withholding calculation. Time and attendance monitoring just got a whole lot easier.

Try changing your withholdings filing status or retirement savings and. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. This calculator uses the latest.

Use this calculator to help you determine the impact of changing your payroll deductions. Get Started With ADP Payroll.

Understanding Your Paycheck

Understanding Your Paycheck Credit Com

Paycheck Calculator Take Home Pay Calculator

Federal Income Tax Fit Payroll Tax Calculation Youtube

Payroll Calculator 2020 Deals 51 Off Www Ingeniovirtual Com

Take Home Pay Calculator

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Gross Pay And Net Pay What S The Difference Paycheckcity

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android

Financial Literacy Gross Pay Payroll Deductions Net Pay 8th Grade Math Youtube

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Take Home Pay Calculator

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Paycheck Calculator Online For Per Pay Period Create W 4

Solved W2 Box 1 Not Calculating Correctly